P398 Exploring Possibilities With PolyJet Technolo...

of verifiable CPD

In collaboration with The College of General Dentistry. Join us for an insightful webinar exploring the late...

ViewIndividual or Group Subscription members have access to courses relevant to their registered profession as part of their membership. Courses not intended for the registered profession can be purchased by the individual member.

Access to courses on the Premium Learning page are NOT included in the membership.

PAYG members can purchase access to any course listed on the E-Learning, Webinar and Premium Learning pages.

All Webinars listed are FREE to view on the date and time of the scheduled broadcast. A fee will be applied for the CPD certificate when it is claimed by non-subscription members.

of verifiable CPD

In collaboration with The College of General Dentistry. Join us for an insightful webinar exploring the late...

View

.png)

of verifiable CPD

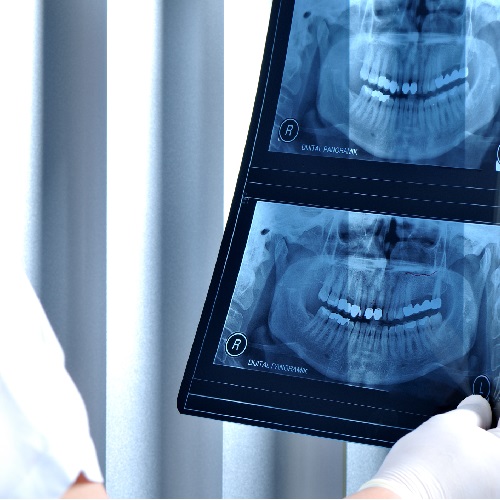

This course will provide the dental team who take X-rays and have other roles in the production of an X-ray image with inf...

More Info Purchase CPD

.png)

of verifiable CPD

This course will provide the dental team who take X-rays and have other roles in the production of an X-ray image with inf...

More Info Purchase CPD

.png)

of verifiable CPD

This course is designed to equip the dental team, including those responsible for taking x-rays and performing other tasks...

More Info Purchase CPD

.png)

of verifiable CPD

This course provides the dental team who take X-rays and have other roles in the production of an X-ray image with informa...

More Info Purchase CPD

.png)

of verifiable CPD

This course will provide the dental team who take X-rays and have other roles in the production of an X-ray image with inf...

More Info Purchase CPD

of verifiable CPD

This course will provide the dental team who do not take but may or may not have a role in the production of an X-ray imag...

More Info Purchase CPD

of verifiable CPD

This course will provide members of the dental team who do not take, but may or may not have a role in the production of, ...

More Info Purchase CPD

of verifiable CPD

This course is designed to equip the dental team, including those responsible for taking x-rays and performing other tasks...

More Info Purchase CPD

of verifiable CPD

This course provides the dental team who do not take, but may or may not have a role in the production of an X-ray image w...

More Info Purchase CPD

of verifiable CPD

This course will provide the dental team who do not take, but may or may not have a role in the production of an X-ray ima...

More Info Purchase CPD

.png)

of verifiable CPD

In collaboration with CGDent this recorded webinar covers the content of the Dental Guidance Notes – 2nd Edition and...

More Info Purchase CPD

of verifiable CPD

This training course is specifically tailored for non-clinical staff. If you are a clinical dental team m...

More Info Purchase CPD

of verifiable CPD

This advanced level course is specifically tailored for clinical staff and inc...

More Info Purchase CPD

of verifiable CPD

Safeguarding means protecting people’s health, wellbeing and human rights, and enabling them to live free from harm,...

More Info Purchase CPD

of verifiable CPD

This course provides learners with information about infection control and decontamination in the dental practice....

More Info Purchase CPD

of verifiable CPD

This course will provide learners with essential information about personal protective equipment and why it is required.

More Info Purchase CPD

of verifiable CPD

This course outlines the requirements for reprocessing dental instruments and will help learners to comply with HT...

More Info Purchase CPD

of verifiable CPD

This course aims to provide learners with an in-depth look at the transportation, packaging and storage of dental instrume...

More Info Purchase CPD

of verifiable CPD

This course will provide learners with an understanding of what is meant by surface cleaning is and when it should be perf...

More Info Purchase CPD

of verifiable CPD

This course will teach learners how to comply with the waste disposal training requirement of HTM 07-01.

More Info Purchase CPD

of verifiable CPD

In this series of webinars, presented by Keerut Oberai, attendees will gain an overview of the topic of dental ethics. To ...

More Info Purchase CPD

of verifiable CPD

This is the second webinar in the Dental Ethics series, presented by Keerut OberaiThis recorded webinar aims to h...

More Info Purchase CPD

of verifiable CPD

This third recorded webinar in the Dental Ethics series presented by Keerut Oberai discusses the topics of consent and cap...

More Info Purchase CPD

of verifiable CPD

Mouth Cancer Action Month is held in November every year and is supported by the Mouth Cancer Foundation and the Oral...

More Info Purchase CPD

of verifiable CPD

Mouth Cancer Action Month is held in November every year and is supported by the Mouth Cancer Foundation and the Oral...

More Info Purchase CPD

of verifiable CPD

This course provides information about the role and responsibility of dental professionals in preventing and handling comp...

More Info Purchase CPD

of verifiable CPD

This presentation features discussions of how disability can impact providing oral health and treatment. Dental care profe...

More Info Purchase CPD

of verifiable CPD

An ‘ABCDE’ approach to managing deteriorating patients has proved an effective method of recognising deteriora...

More Info Purchase CPD

of verifiable CPD

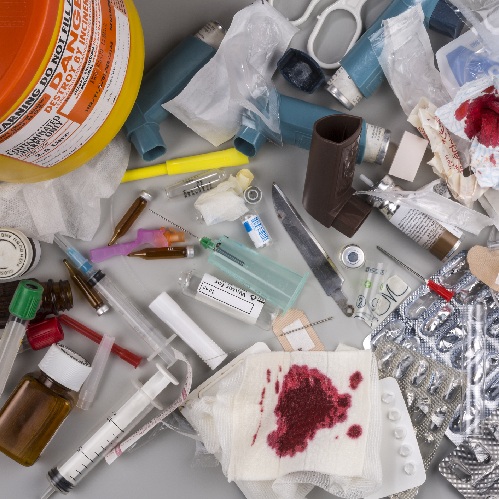

This course provides information on essential knowledge for dental teams about their medical emergency equipment kit....

More Info Purchase CPD

of verifiable CPD

This online training course equips dental professionals with the essential knowledge and skills to handle sharps safely an...

More Info Purchase CPD

of verifiable CPD

The aim of this course is to understand what to do if a patient has asthma....

More Info Purchase CPD

of verifiable CPD

of verifiable CPD

The aim of this course is to understand how to manage obstructed airways and conduct good patient care both before and aft...

More Info Purchase CPD

of verifiable CPD

This article contains guidelines for the use of automated external defibrillators (AEDs) by laypeople, first responders an...

More Info Purchase CPD

of verifiable CPD

The aim of this course is to understand how to manage a heart attack and undertake appropriate patient care during and aft...

More Info Purchase CPD

of verifiable CPD

This course aims to provide an understanding of stroke also known as a cerebrovascular accident (CVA)....

More Info Purchase CPD

of verifiable CPD

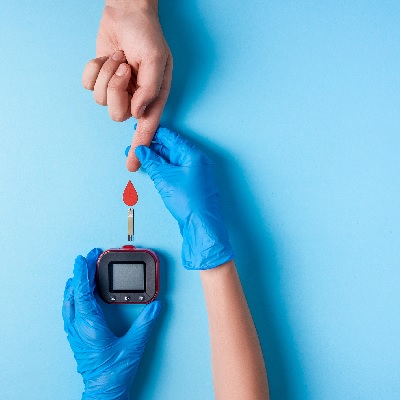

The aim of this course is to increase awareness of diabetes mellitus and to enable the dental team to recognise and respon...

More Info Purchase CPD

of verifiable CPD

of verifiable CPD

This course provides information about sepsis including the definition and causes, and the implications for dental practic...

More Info Purchase CPD

of verifiable CPD

The aim of this course is to assist staff with their understanding of what is involved in Adult Basic Life Support and how...

More Info Purchase CPD

of verifiable CPD

Esthetic restorations represent a significant and increasing portion of dental services and income. Closely related to the...

More Info Purchase CPD

of verifiable CPD

The plethora of ceramic systems available today for all types of indirect restorations can be confusing and overwhelming f...

More Info Purchase CPD

of verifiable CPD

The 1950s and 1960s have often been called the Golden Age of Dentistry - as patients flocked to dental offices to address ...

More Info Purchase CPD

of verifiable CPD

Bonding porcelain restorations can be problematic and time consuming, which has caused many dentists to avoid using bonded...

More Info Purchase CPD

of verifiable CPD

All GDC registrants involved in prescribing, manufacturing and fitting dental appliances have a role to play in protecting...

More Info Purchase CPD

of verifiable CPD

Effective and regular maintenance of equipment in a dental laboratory is essential to the day to day use and efficacy of t...

More Info Purchase CPD

of verifiable CPD

In collaboration with The College of General Dentistry.The bedrock of delivering cosmetic dentistry remains effec...

More Info Purchase CPD

of verifiable CPD

In collaboration with BADN and CGDent, this recorded webinar explores how dental professionals play an essential role in t...

More Info Purchase CPD

of verifiable CPD

In collaboration with the British Association of Dental Nurses and the College of General Dentistry, this recorded webinar...

More Info Purchase CPD

of verifiable CPD

Do you often feel as though you are running on a hamster wheel, expending lots of energy, but wondering if you’re ac...

More Info Purchase CPD

of verifiable CPD

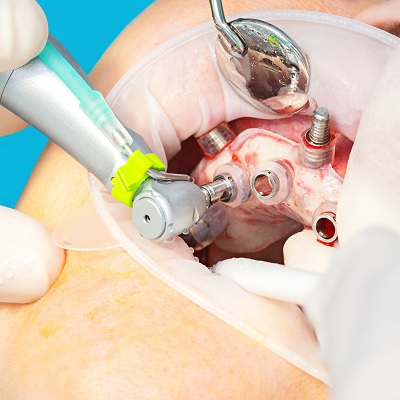

The advantages of the Densah bur system to improve bone quality in implant patients....

More Info Purchase CPD

of verifiable CPD

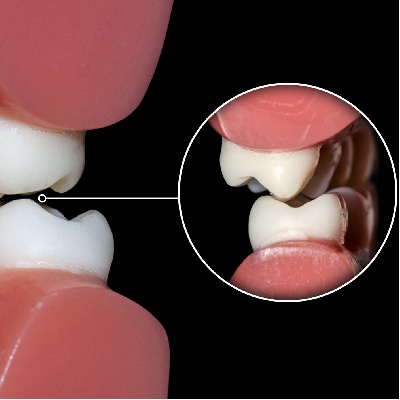

This recorded webinar will help guide the decision of how to plan and perform modification of the gingival contour in the ...

More Info Purchase CPD

of verifiable CPD

This recorded lecture gives deep insights in the Concept of Biological Bone Augmentation (BBA) with pure autogenous bone a...

More Info Purchase CPD

of verifiable CPD

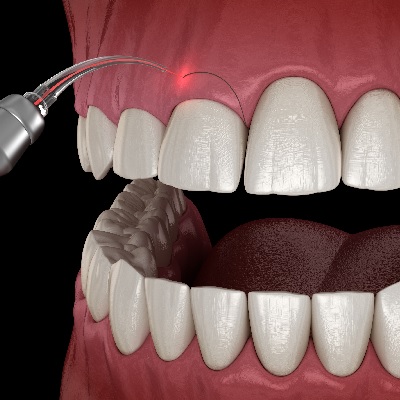

Development in the field of laser dentistry has taken place at a rapid pace in recent years. Therapeutic concepts that see...

More Info Purchase CPD

of verifiable CPD

This recorded webinar looks at the advantages of pterygoid implants for patients with limited bone in the maxilla

More Info Purchase CPD

of verifiable CPD

A recording of a live webinar looking at all the options for replacing missing teeth....

More Info Purchase CPD

of verifiable CPD

This recorded webinar will revise the principles of pulp diagnosis and health. In the absence of pulp health due to ...

More Info Purchase CPD

of verifiable CPD

This recorded webinar Looks at the impact of occlusion on restoration success and failure, and also the maintenance of the...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is aimed at igniting your enthusiasm and love for dentures, showing how we can change our patients&r...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is aimed at dentists to guide them through most frequently asked questions....

More Info Purchase CPD

of verifiable CPD

Optimising host healing with synthetic graft materials. This course looks at the abilities of synthetic...

More Info Purchase CPD

of verifiable CPD

During this recorded webinar we discuss common complications and how to treat them....

More Info Purchase CPD

of verifiable CPD

The objective of this recorded webinar presentation is to provide a systematic workflow for data capture in clinic to allo...

More Info Purchase CPD

of verifiable CPD

A discussion of the clinical process from presentation of a dental trauma to discharge considering some of the evidence ba...

More Info Purchase CPD

of verifiable CPD

More and more people are wearing their teeth and the management of this wear is critical to successful treatment. This rec...

More Info Purchase CPD

of verifiable CPD

This recorded lecture will look frankly and controversially at the way our industry operates and the kind of patients many...

More Info Purchase CPD

of verifiable CPD

What's new in digital dental workflows and how that can be utilised in general practice to enhance the patient experience,...

More Info Purchase CPD

of verifiable CPD

This recorded webinar looks at the role of CBCT in implant dentistry including training and regulations....

More Info Purchase CPD

of verifiable CPD

Speaker Mike Gow, has had a passion for helping people who have dental anxiety and phobia for many years and will share hi...

More Info Purchase CPD

of verifiable CPD

Speaker Amin Aminian - This recorded webinar will discuss advanced concepts in occlusion with a brief overview of restorat...

More Info Purchase CPD

of verifiable CPD

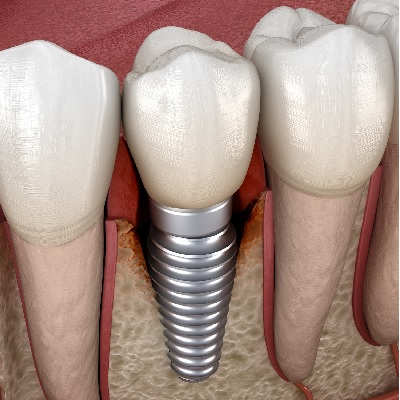

This recorded webinar provides a balanced introduction to planning, placing and restoring dental implants....

More Info Purchase CPD

of verifiable CPD

This recorded webinar will discuss the different techniques for soft tissue modelling around single tooth implant restorat...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is aimed at dentists looking at their retirement planning and is focused on the dental practice sale...

More Info Purchase CPD

of verifiable CPD

This recorded webinar looks at the different types of pathogens and highlight the requirements to mitigate the risks based...

More Info Purchase CPD

of verifiable CPD

For many years dentistry has been dominated by prevailing occlusal concepts that were initially presented in the 60’...

More Info Purchase CPD

of verifiable CPD

Plaque formed on the surfaces of removable dentures can have a significant impact on oral health, as long as it can lead t...

More Info Purchase CPD

of verifiable CPD

This recorded webinar looks at planning and communicating creatively in the digital world....

More Info Purchase CPD

of verifiable CPD

This recorded presentation will discuss the key evolutions in apical surgery that ensure this is a predictable treatment m...

More Info Purchase CPD

of verifiable CPD

This presentation by Jon Drysdale considers the financial planning ‘crossroads’ that dentists are faced with a...

More Info Purchase CPD

of verifiable CPD

In an increasingly litigious society, with dentistry changing rapidly speaker Kiaran Weil presents a recorded webinar taki...

More Info Purchase CPD

of verifiable CPD

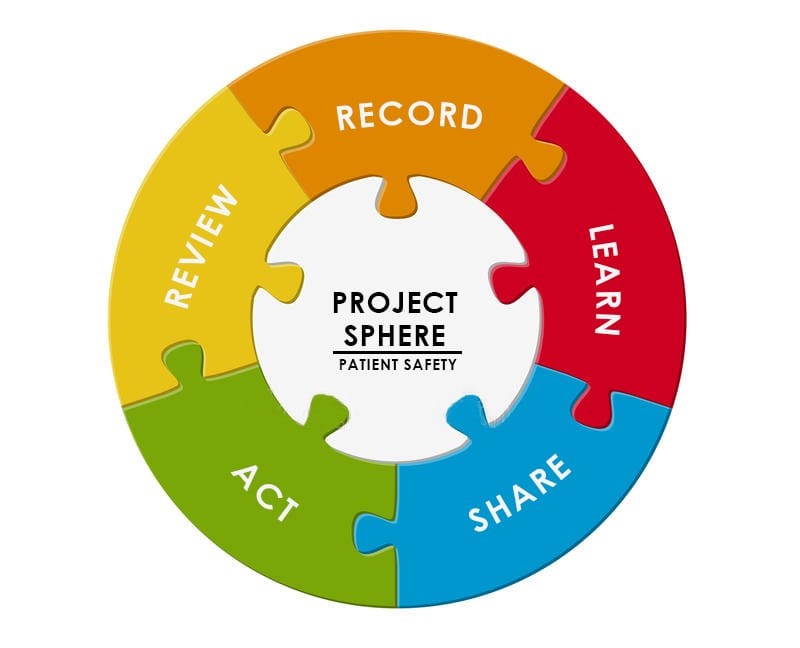

In collaboration with FGDP and CGDent.This recorded discussion will look at real life examples and highlight ways...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will focus on how we can use friction to retain an implant crown, the thinking, the process and the ...

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry.Mentoring in Implant Dentistry has significantly changed o...

More Info Purchase CPD

of verifiable CPD

Our diet and lifestyles contribute to our change in oral health. More patients are being seen with severe tooth wear, whet...

More Info Purchase CPD

of verifiable CPD

The role of a treatment coordinator (TCO) can reduce chair time for the clinician, improve patient satisfaction and increa...

More Info Purchase CPD

of verifiable CPD

The content of this course was correct on the date of the live broadcast 18.8.2020.Dentistry in ...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is a relatively short presentation on the large topic of Dental Implant Nursing. Implant Dentistry i...

More Info Purchase CPD

of verifiable CPD

This recorded webinar discusses 4-handed techniques for general practice and highlight the many benefits to dentists, dent...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will consider the benefits of rubber dam use in endodontics and restorative dentistry and techniques...

More Info Purchase CPD

of verifiable CPD

This recorded webinar introduces the dental team to nutrition and the effects of sugar on the body....

More Info Purchase CPD

of verifiable CPD

This recorded webinar will look at the role that everyone has to play in safeguarding antibiotics for future generations.

More Info Purchase CPD

of verifiable CPD

“Our patients are adaptable”, that’s what I hear but how do we know. Do they adapt by reducing the chewi...

More Info Purchase CPD

of verifiable CPD

This recorded webinar, although primarily aimed at dentists about to begin their first self-employed associate role, will ...

More Info Purchase CPD

of verifiable CPD

Unerupted maxillary canines can present a challenge for the general dental practitioner. Recognising when maxillary canine...

More Info Purchase CPD

of verifiable CPD

How would it be if I could show you, in one hour, how to change your life & career forever? To increase the performanc...

More Info Purchase CPD

of verifiable CPD

This recorded webinar, presented by Natalie Bradley, looks at the problem of homelessness in the UK, the oral health needs...

More Info Purchase CPD.jpg)

of verifiable CPD

IV Sedation is a very safe treatment but complications do happen. To build confidence for the entire team this recorded we...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will help you through those challenging HR issues, from getting the team back to work, to redundancy...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will discuss Dr Mahony’s PhD research looking into the multidisciplinary approach to...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will provide a basic introduction to employment law, covering legal matters which are relevant for t...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is aimed at dentists looking at their retirement planning and is focused on the dental practice sale...

More Info Purchase CPD

of verifiable CPD

The CSR Advantage addresses your business’ next big challenge and how to turn it to an opportunity.This rec...

More Info Purchase CPD

of verifiable CPD

This recorded webinar provides a whistle stop tour of all the key perio topics relevant in general practice...

More Info Purchase CPD

of verifiable CPD

The content of this course was correct on the date of the live broadcast 12.11.2020.The Malcom P...

More Info Purchase CPD

of verifiable CPD

Are you interested in giving back as a dental professional?This recorded webinar, for the entire team, has a seri...

More Info Purchase CPD

of verifiable CPD

Do Teeth Matter? Oral Health of People who Experience Homelessness - The first in the webinar series 'De...

More Info Purchase CPD

of verifiable CPD

This recorded webinar shares knowledge from aviation, medicine, dentistry and delivers relevant tips for dental practice, ...

More Info Purchase CPD

of verifiable CPD

This recorded webinar looks at real life examples of gender inequality and highlight ways in which we can reduce inequalit...

More Info Purchase CPD

of verifiable CPD

of verifiable CPD

Presented by Natalie BradleyThe Mobile Dentist, Providing Treatment Using a Mobile Dental Surgery.

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry, this recorded webinar explores the best way to handle a complant b...

More Info Purchase CPD

of verifiable CPD

Audit is something we know we're meant to do, when used correctly audit can be a powerful tool to bring about change and i...

More Info Purchase CPD

of verifiable CPD

The content of this course was correct on the date of the live broadcast 19.9.2020.A recording o...

More Info Purchase CPD

of verifiable CPD

The content of this course was correct on the date of the live broadcast 8.4.2021.This recorded ...

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry.Dental extractions are one of the most commonly undertaken...

More Info Purchase CPD

of verifiable CPD

This recorded webinar introduces mediation, explaining how it can be a useful tool when attempting to resolve disputes wit...

More Info Purchase CPD

of verifiable CPD

This course will provide you with detail to apply knowledge of legionella bacteria, the law and management of legionella a...

More Info Purchase CPD

of verifiable CPD

Orthodontic demand is growing all the time. It is useful before a patient is referred to an orthodontist to be able to adv...

More Info Purchase CPD

of verifiable CPD

Why is there inequality?Where is there inequality?How can we change this?When can ...

More Info Purchase CPD

of verifiable CPD

This recorded webinar produced in collaboration with FGDP and The College of General Dentistry is presented by Dr Hea...

More Info Purchase CPD

of verifiable CPD

This recorded webinar presented by Simon Manian and Philip Mullen, looks into endodontic treatment, knowing when to r...

More Info Purchase CPD

of verifiable CPD

This recorded webinar produced in collaboration with FGDP and The College of General Dentistry is presented by Dr Hea...

More Info Purchase CPD

of verifiable CPD

In this recorded webinar Martyn Bradshaw of PFM Dental gives an overview of the current market, valuing a dental practice,...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will show the use of the bone ring techniques and discuss its applications and limitations....

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry this recorded webinar discusses the importance of comprehensive and...

More Info Purchase CPD

of verifiable CPD

In this recorded webinar Dr Mahmood Mawjee, the founder of Re-IGNITE, explains how he overcame the stress and anxiety of c...

More Info Purchase CPD

of verifiable CPD

In collaboration with BOS (British Orthodontic Society), this is the fourth webinar in a series of five designed for Gener...

More Info Purchase CPD

of verifiable CPD

The recorded webinar is in collaboration with the British Orthodontic Society and the College of General Dentistry. Certai...

More Info Purchase CPD

of verifiable CPD

This recorded webinar provides an update on the safe and effective provision of inhalation sedation, looking at equipment,...

More Info Purchase CPD

of verifiable CPD

In collaboration with The British Dental Students' Association (BDSA) and CGDent. Owning a practice provides huge opportun...

More Info Purchase CPD

of verifiable CPD

Risk-taking in the business of dentistry can be perilous, using case studies of dentists they have previously helped, Nath...

More Info Purchase CPD

of verifiable CPD

This recorded webinar, hosted by the University of Manchester (UoM) Antimicrobial Resistance (AMR) Network, is an opportun...

More Info Purchase CPD

of verifiable CPD

This recorded webinar looks at sustainability in dentistry and healthcare, with a fantastic panel of leading experts in th...

More Info Purchase CPD

of verifiable CPD

In collaboration with the Society of British Dental Nurses and the College of General Dentistry, this recorded webinar pro...

More Info Purchase CPD

of verifiable CPD

This recorded webinar provides an overview of intravenous sedation for dental practice....

More Info Purchase CPD

of verifiable CPD

There is a culture of fear and anxiety that affects many clinicians in dental settings. This can lead to defensive dentist...

More Info Purchase CPD

of verifiable CPD

All dentists, doctors and DCPs providing conscious sedation for NHS or private dental patients must do so in compliance wi...

More Info Purchase CPD

of verifiable CPD

Is beauty in the eye of the beholder? Does malocclusion impact on psychosocial well-being? What motivates people to seek o...

More Info Purchase CPD

of verifiable CPD

This recorded webinar discusses what the term 'innovation' means and give a practical definition. The latest oral hygiene ...

More Info Purchase CPD

of verifiable CPD

Not sure where to go next in your career? Not sure which courses to take? Not sure what opportunities are available to you...

More Info Purchase CPD

of verifiable CPD

In collaboration with BOS (British Orthodontic Society), this is the final webinar in a series of five designed for Genera...

More Info Purchase CPD

of verifiable CPD

This is the second recorded webinar in the series for dental technicians.The prosthetic rehabilitation of Head an...

More Info Purchase CPD

of verifiable CPD

A series of short presentations looking at different aspects of surgical and restorative implant failure.This rec...

More Info Purchase CPD

of verifiable CPD

In collaboration with CGDent.This recorded webinar looks at women in dentistry and the positive change in gender ...

More Info Purchase CPD

of verifiable CPD

This recorded CGDent webinar looks at the global efforts in tackling antimicrobial resistance locally....

More Info Purchase CPD

of verifiable CPD

This recorded webinar for the entire dental team both introduces the opportunities available for the dental team to get in...

More Info Purchase CPD

of verifiable CPD

Autotransplantation is an under-utilised technique in which a tooth is surgically repositioned within the same patient. It...

More Info Purchase CPD

of verifiable CPD

The Dental Technician Magazine and ProDental CPD launched DTCPD, an exciting new scheme for dental technicians to join sel...

More Info Purchase CPD

of verifiable CPD

This CGDent recorded webinar examines the issue of professionalism in relation to dental colleagues, and how it impacts up...

More Info Purchase CPD

of verifiable CPD

This CGDent recorded webinar aims to explore some myths about leadership and understand the importance of leadership in de...

More Info Purchase CPD

of verifiable CPD

This recorded webinar provides an overview of some key medical conditions, which the clinician should be familiar with, an...

More Info Purchase CPD

of verifiable CPD

Are you the person in the team who bounces from solving one problem to solving the next? Do you feel as though you n...

More Info Purchase CPD

of verifiable CPD

While immediate implant placement into extraction sockets has gained in popularity in recent years, there are a number of ...

More Info Purchase CPD

of verifiable CPD

This three-part webinar series in collaboration with the College of General Dentistry and led by...

More Info Purchase CPD

of verifiable CPD

What is professionalism, who defines it, what is it worth, does it apply to technicians?This recorded webinar loo...

More Info Purchase CPD

of verifiable CPD

This CGDent recorded webinar explores the main changes in the IADT 2020 Guidelines for the Management of Traumatic Dental ...

More Info Purchase CPD

of verifiable CPD

The goal of this Bridge2Aid recorded webinar is to provide a platform for people working in the remote, rural and humanita...

More Info Add to Learning Plan

of verifiable CPD

This recorded webinar looks at the rehabilitation of patients with maxillary and mid-facial malignancy using Zygomatic Imp...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is the first of two webinars which aim to raise awareness and understanding around the NHS dental co...

More Info Purchase CPD

of verifiable CPD

The second recorded webinar in the series aims to raise awareness and understanding around the NHS dental contract changes...

More Info Purchase CPD

of verifiable CPD

This recorded webinar helps you to discover how to motivate, encourage and grow your team into a successful practice....

More Info Purchase CPD

of verifiable CPD

In order to improve the outcomes of implant treatments in highly aesthetic areas and to prevent ridge collapse post extrac...

More Info Purchase CPD

of verifiable CPD

This recorded webinar explores recent research about custom-made mouthguards and the effects of design differences on pati...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will look at how to support implant patients through their treatment journey using a team approach a...

More Info Purchase CPD

of verifiable CPD

In this CGDent recorded webinar, speakers examine the issues surrounding social inequalities and consider how they may aff...

More Info Purchase CPD

of verifiable CPD

Guided surgery for implant placement is not a new concept in implant dentistry. Restoratively driven implant placement is ...

More Info Purchase CPD

of verifiable CPD

In collaboration with CGDent this recorded webinar provides assistance to strengthen and develop dental teams’ relat...

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry, we explore how with knowledge, understanding and experience, analo...

More Info Purchase CPD

of verifiable CPD

This recorded webinar aims to raise the profile of community water fluoridation amongst all of the dental team, explaining...

More Info Purchase CPD

of verifiable CPD

Guided Bone Regeneration is a procedure all dentists placing implants should be competent in. However, performing these pr...

More Info Purchase CPD

of verifiable CPD

This course takes an in-depth look at sexual harassment in the workplace, specifically tailored for dental teams....

More Info Purchase CPD

of verifiable CPD

Appraisals are often seen as something we must do because it meets compliance requirements and because we know it’s ...

More Info Purchase CPD

of verifiable CPD

This course will provide learners with an understanding of the fundamentals of the Mental Capacity Act....

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry, this recorded webinar was co-hosted by Ian Wilson (founder of Brid...

More Info Purchase CPD

of verifiable CPD

This recorded webinar explores different treatment options for managing carious primary and permanent molars. The speakers...

More Info Purchase CPD

of verifiable CPD

With the ongoing integration of digital technologies into everyday practice, learn how you and your patients can benefit f...

More Info Purchase CPD

of verifiable CPD

Worn anterior teeth can pose a dilemma in terms of the correct management, best use of materials, most conservative approa...

More Info Purchase CPD

of verifiable CPD

There has always been a widespread misplaced belief that the duty of candour was introduced to fix a problem in medical/ho...

More Info Purchase CPD

of verifiable CPD

In this recorded webinar speaker Jennifer Malpass takes you on a her journey through her career as a Dental Nurse leading ...

More Info Purchase CPD

of verifiable CPD

Are you an informed clinician? The main aim of this recorded webinar is to encourage clinicians to keep up to date with de...

More Info Purchase CPD

of verifiable CPD

This course based on a recorded webinar is the first in the CGDent 'Research and Critical Appraisal of Evidence' series of...

More Info Purchase CPD

of verifiable CPD

This is the second CGDent Lunch and Learn recorded webinar in the 'Research and Critical Appraisal of Evidence' series of ...

More Info Purchase CPD

of verifiable CPD

This is the third CGDent Lunch and Learn webinar in the 'Research and Critical Appraisal of Evidence' series of recorded w...

More Info Purchase CPD

of verifiable CPD

Hosted by leading practice sales agency, PFM Dental, this recorded webinar is ideal for those interested in purchasing a d...

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry and Apolline.This recorded webinar provides an overview of...

More Info Purchase CPD

of verifiable CPD

This recorded webinar, in collaboration with the British Orthodontic Society and presented by Dr Nadia Ahmed, provide...

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry and Office of Chief Dental Officer England, this recorded webinar d...

More Info Purchase CPD

of verifiable CPD

This three-part webinar series in collaboration with the College of General Dentistry and led by specialist orthodontist P...

More Info Purchase CPD

of verifiable CPD

Presented by Dr David Johnson, acupuncture is a technique whereby diseases can be either cured or alleviated - or put in o...

More Info Purchase CPD

of verifiable CPD

In November 2020 Bridge2Aid hosted a 2 day conference on ‘Remote and Rural Healthcare – How Can we do it Bette...

More Info Purchase CPD

of verifiable CPD

Louisa Sherlock discusses the question 'Are dental practice principals vicariously liable for the negligence of their asso...

More Info Purchase CPD

of verifiable CPD

This recorded webinar discusses:Business culture, giving examples of positive culture and using it to comm...

More Info Purchase CPD

of verifiable CPD

This virtual study session came about following discussions on the importance of monitoring water systems to understand th...

More Info Purchase CPD

of verifiable CPD

In collaboration with CGDent and FGDP, speaker Jalpesh Patel presents the first webinar of this clinical series will explo...

More Info Purchase CPD

of verifiable CPD

The first recording of this webinar series hosted by The Dental Technician Magazine editor and S4S Laboratory director Mat...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is the third in a three part series series and it discusses orthodonti...

More Info Purchase CPD

of verifiable CPD

Presented by Richard Jones in collaboration with BOS (British Orthodontic Society)This is the second recorded web...

More Info Purchase CPD

of verifiable CPD

In collaboration with BOS (British Orthodontic Society), this is the third webinar in a series of five designed for Genera...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is in collaboration with the College of General Dentistry and the Dental Professional Alliance. Host...

More Info Purchase CPD

of verifiable CPD

This is the second webinar in this series, delivered by Jalpesh Patel, in collaboration with CGDent. This presentation enc...

More Info Purchase CPD

of verifiable CPD

Speakers Sami Stagnell, Oral Surgeon & Arti Hindocha, Orthodontist present together in this recorded webinar to provid...

More Info Purchase CPD

of verifiable CPD

This is the third webinar in this series in collaboration with CGDent, which encompass an overview of Non-Surgical Facial ...

More Info Purchase CPD

of verifiable CPD

Clinical situations that fall within the scope of oral medicine practice are common, but it isn’t always clear how c...

More Info Purchase CPD

of verifiable CPD

Snoring is not necessarily a benign condition; it can be linked to the serious condition obstructive sleep apnoea (OSA). W...

More Info Purchase CPD

of verifiable CPD

In November 2020 Bridge2Aid hosted a 2 day conference on 'Remote and rural healthcare – how can we do it better?'....

More Info Purchase CPD

of verifiable CPD

This webinar will explore the role of patient and citizen facing technology. We discuss chatbots, apps, and what the role ...

More Info Purchase CPD

of verifiable CPD

The first of a two-part webinar series in collaboration with the College of General Dentistry, presented by Caroline Persa...

More Info Purchase CPD

of verifiable CPD

This recorded webinar discusses the skill of reflective practice within the context of learning ...

More Info Purchase CPD

of verifiable CPD

When you think about communicating with your team what comes up for you? Sharing information and updating? Mak...

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry, this recorded webinar discusses the new ultra short acting benzodi...

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry, this recorded webinar discusses how Ramadan, which commences aroun...

More Info Purchase CPD

of verifiable CPD

This decision of who to treat and who to not treat creates all sorts of problems for orthodontist, patient and GDP since a...

More Info Purchase CPD

of verifiable CPD

This recorded webinar offers a personal story of the devastating impact of suicide on family, friends and colleagues and a...

More Info Purchase CPD

of verifiable CPD

This recorded webinar provides learners with an understanding of dental handpieces and highlights the importance of g...

More Info Purchase CPD

of verifiable CPD

This recorded webinar equips learners with the knowledge of each role required in a dental practice and the responsibiliti...

More Info Purchase CPD

of verifiable CPD

When we think of hypnosis it may conjure in our minds people on a stage being asked to dance like chickens, so how then ca...

More Info Purchase CPD

of verifiable CPD

The second of a two-part recorded webinar series in collaboration with the College of General Dentistry, presented by Caro...

More Info Purchase CPD

of verifiable CPD

With advances in dental healthcare technology, hygienists no longer have to watch periodontal disease progress and wait un...

More Info Purchase CPD

of verifiable CPD

There has been a significant increase in the knowledge and understanding of the aetiology, pathogenesis, and treatment of ...

More Info Purchase CPD

of verifiable CPD

Polypharmacy in the nation’s growing geriatric population will require increasingly complex pharmacologic management...

More Info Purchase CPD

of verifiable CPD

This course covers both the professional and statutory duty of candour. It looks at the importance of open...

More Info Purchase CPD

of verifiable CPD

Medical emergencies in general dental practice are thankfully a rare occurrence but they can occur at any time. This artic...

More Info Purchase CPD

of verifiable CPD

Health professionals have a new opportunity to help prevent tooth decay in young children and root caries in older people....

More Info Purchase CPD

of verifiable CPD

Pre-eclampsia and preterm delivery of low birth weight infants (PLBW) remains a significant public health issue and a lead...

More Info Purchase CPD

of verifiable CPD

Oral infection, especially gingivitis and periodontitis may affect course and pathogenesis of a number of systemic disease...

More Info Purchase CPD

of verifiable CPD

This foundation course explains how dentistry contributes to climate change and ecological degradation, and helps dental c...

More Info Purchase CPD

of verifiable CPD

This course guides learners through CQC inspections, explaining what to expect during an inspection under the Single Asses...

More Info Purchase CPD

of verifiable CPD

This paper is an introduction to dental anxiety, fear and phobia for all of the dental team - please encourage them all to...

More Info Purchase CPD

of verifiable CPD

Injecting local anaesthetics can become routine for dental practitioners because of the high efficacy and wide safety marg...

More Info Purchase CPD

of verifiable CPD

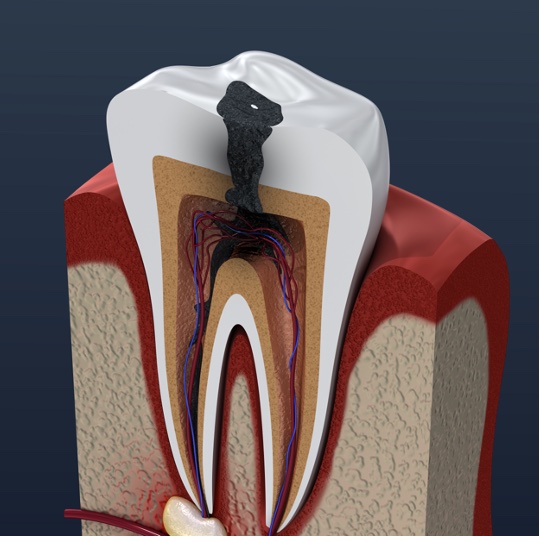

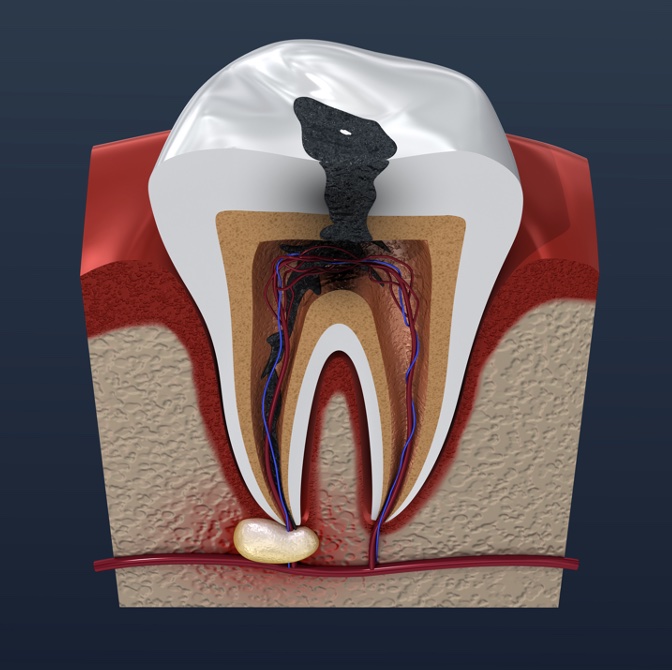

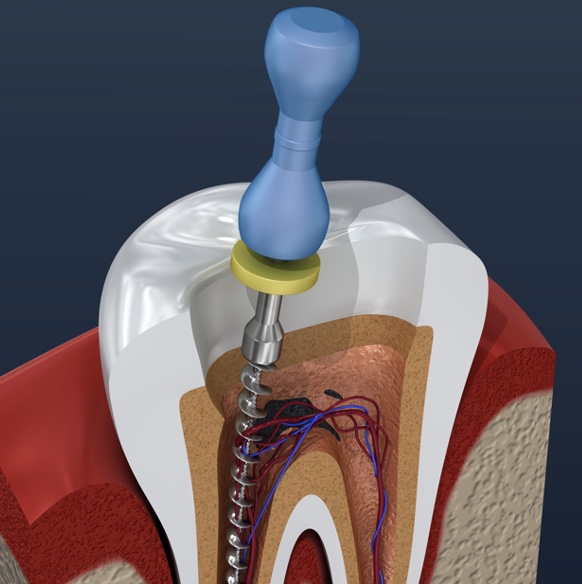

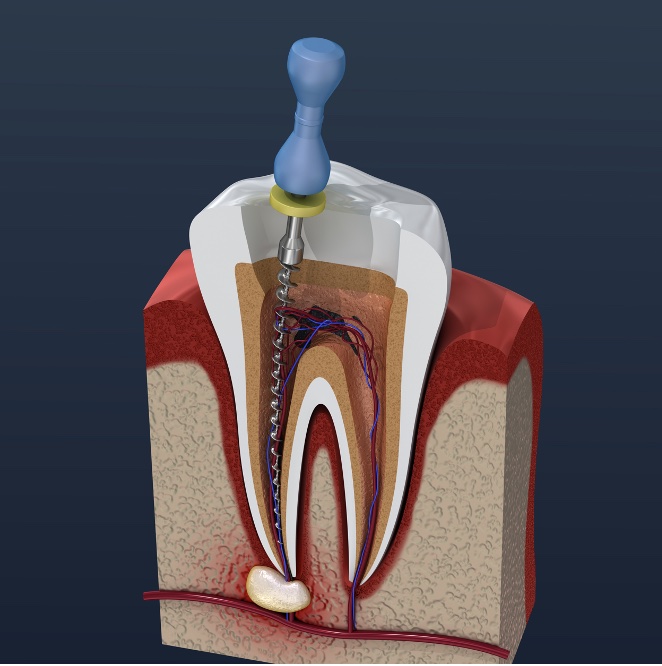

This is the first module in our Endodontics series of 10 recorded webinars. It covers the first aspect in p...

More Info Purchase CPD

of verifiable CPD

This is the second module in our Endodontics series of 10 recorded webinars. It covers pain control in endo...

More Info Purchase CPD

of verifiable CPD

This is the third module in our Endodontics series of 10 recorded webinars. It covers rubber dam isolation ...

More Info Purchase CPD

of verifiable CPD

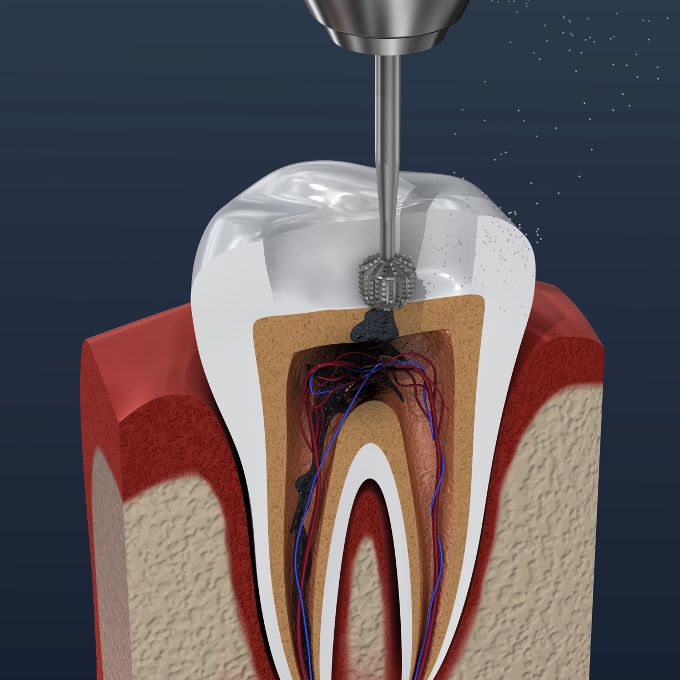

This is the fourth module in our Endodontics series of 10 recorded webinars. It covers endodontic workflow ...

More Info Purchase CPD

of verifiable CPD

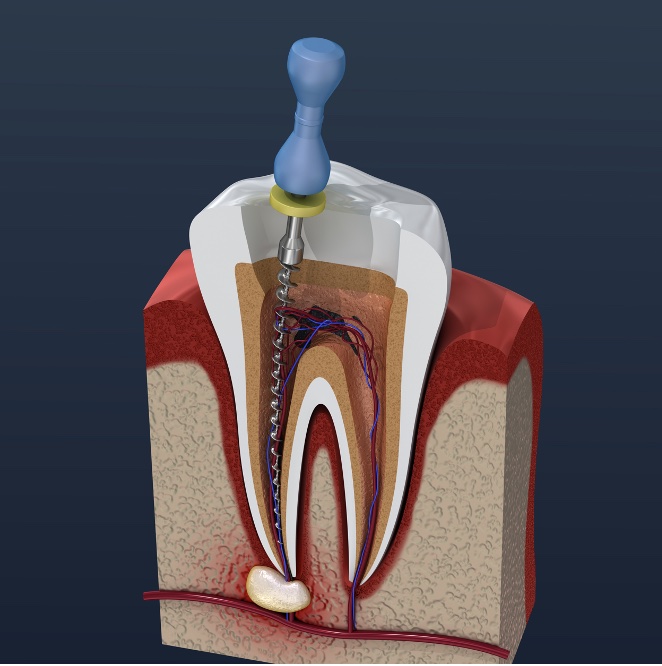

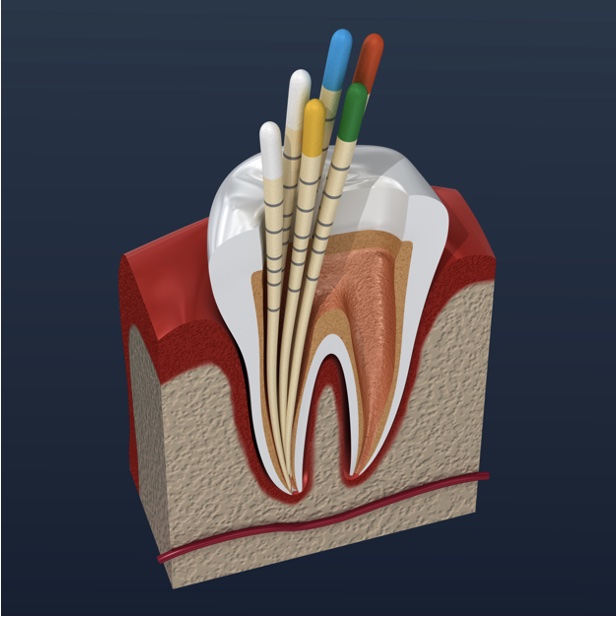

This is the fifth module in our Endodontics series of 10 recorded webinars. It covers root canal anatomy an...

More Info Purchase CPD

of verifiable CPD

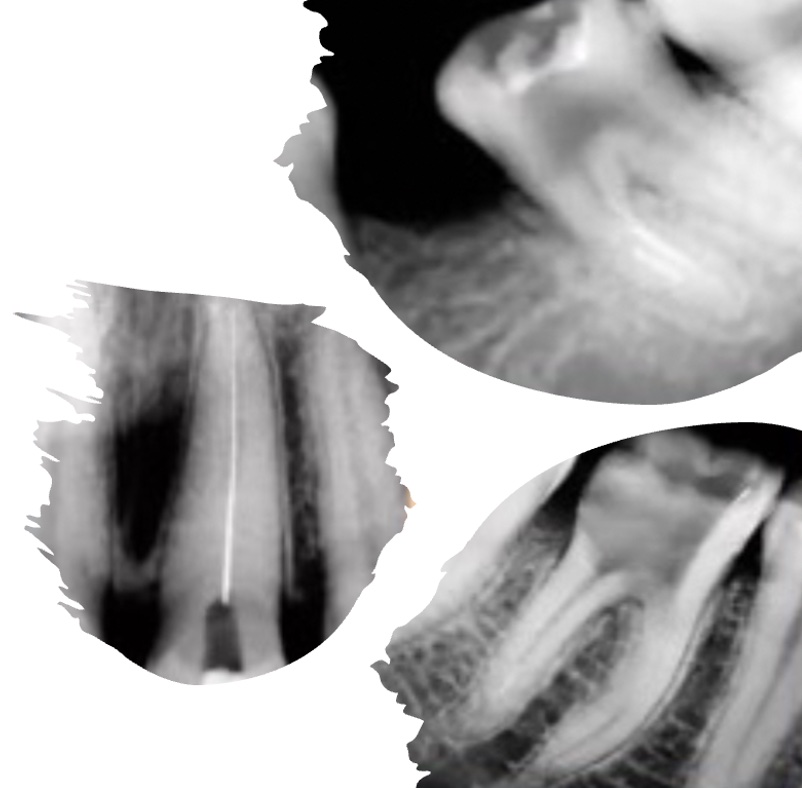

This is the sixth module in our Endodontics series of 10 recorded webinars. It covers working length and ro...

More Info Purchase CPD

of verifiable CPD

This is the seventh module in our Endodontics series of 10 recorded webinars. It covers root canal irrigati...

More Info Purchase CPD

of verifiable CPD

This is the eighth module in our Endodontics series of 10 recorded webinars. It covers endodontic obturatio...

More Info Purchase CPD

of verifiable CPD

This is the ninth module in our Endodontics series of 10 recorded webinars. It covers post endodontic resto...

More Info Purchase CPD

of verifiable CPD

This is the tenth and final module in our Endodontics series of 10 recorded webinars. It covers management ...

More Info Purchase CPD

of verifiable CPD

This is a series of 10 recorded webinars, covering the following topics, which are also available

More Info Purchase CPD

of verifiable CPD

Smoking is the most important public health challenge facing the NHS. Although rates of smoking have steadily declined in ...

More Info Purchase CPD

of verifiable CPD

The effects of discrimination on an individual and on society is rippling. But resistance towards challenging the biases w...

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry.AI is entering our everyday lives – but what is behi...

More Info Purchase CPD

of verifiable CPD

Does your team have ‘thinking together’ skills, as well as ‘acting together’ skills? Both ar...

More Info Purchase CPD

of verifiable CPD

This course outlines the tools necessary to prevent sexual harassment within practices, ensure compliance with the Worker ...

More Info Purchase CPD

of verifiable CPD

In this recorded webinar, Keerut Oberai introduces the topic of data ethics. With the increase in data used in healthcare ...

More Info Purchase CPD

of verifiable CPD

Some people just get on and do what’s needed and others need a little more support. As a leader it’s com...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will look at the effective use of skill-mix in primary dental care for Dental Therapists and De...

More Info Purchase CPD

of verifiable CPD

Do you work with dental therapists? Are you utilising their full scope? Could your therapists be providing more aesthetic ...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will explore the use of the Hall Technique for managing caries in primary molars and will focus...

More Info Purchase CPD

of verifiable CPD

This webinar, in collaboration with the College of General Dentistry, presented by Caroline Persaud and Mike Brindle, will...

More Info Purchase CPD

of verifiable CPD

What do you think of when the word conflict comes up? Most people think of fights or shouting matches. But mos...

More Info Purchase CPD

of verifiable CPD

This recorded webinar aims to raise awareness of whistleblowing and to discuss what our obligations are as dental professi...

More Info Purchase CPD

of verifiable CPD

Placing a dental implant in an extraction site is somewhat different to placing it in a healed site, and even more so when...

More Info Purchase CPD

of verifiable CPD

In this recorded webinar the speakers will explain the importance of language and communication as a tool for not onl...

More Info Purchase CPD

of verifiable CPD

This recorded webinar provides a personal lived experience account of a dental professional living with, in denial from, a...

More Info Purchase CPD

of verifiable CPD

At the beginning of every implantological intervention, especially in compromised situations, there is the reconstruction ...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will give an overview of the evidence base for water fluoridation, the why and how to engage with th...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is designed to equip dental professionals with the knowledge and skills needed to excel in anterior ...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will provide the dental team with an introduction to teeth whitening treatments....

More Info Purchase CPD

of verifiable CPD

This recorded webinar will raise awareness of oral cancer by providing a greater understanding of its causative and contri...

More Info Purchase CPD

of verifiable CPD

This recorded webinar explores the critical importance of sustainability in dental practices. We'll look at why embra...

More Info Purchase CPD

of verifiable CPD

This recorded webinar, in collaboration with The College of General Dentistry, will discuss the implementation of minimum ...

More Info Purchase CPD

of verifiable CPD

In this recorded webinar, we’ll delve into the secrets of maintaining fresh breath and overall oral health. From bru...

More Info Purchase CPD

of verifiable CPD

Stride headfirst into the whirlwind that has turned recruitment and retention upside down. Finding and keeping top talent ...

More Info Purchase CPD

of verifiable CPD

This recorded webinar discusses the challenges that dementia patients have in accessing dental care, particularly the olde...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is designed to inform dentists and DCPs about the regulatory requirements for appropriate indemnity ...

More Info Purchase CPD

of verifiable CPD

Webinar Disclaimer: This recorded webinar features a presentation by an international speaker and is...

More Info Purchase CPD

of verifiable CPD

This recorded webinar delves into the critical aspects of planning for your single tooth indirect restorations. This prese...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will discuss the immediate and long term management of dental trauma. It will give an overview of th...

More Info Purchase CPD

of verifiable CPD

This recorded webinar, presented by Carly Dixon, Specialist in Paediatric Dentistry, provides a comprehensive overvie...

More Info Purchase CPD

of verifiable CPD

This recorded webinar on posterior cuspal coverage restorations, presented by specialist Prosthodontist Josh Sharpling, pr...

More Info Purchase CPD

of verifiable CPD

This recorded webinar will discuss direct access for dental hygienists and dental therapists and the legislative requireme...

More Info Purchase CPD

of verifiable CPD

This recorded webinar discusses different types of complex medical history that can present to the...

More Info Purchase CPD

of verifiable CPD

This recorded webinar discusses the referral criteria for Special Care Dentistry and a few examples of clinical conditions...

More Info Purchase CPD

of verifiable CPD

The World Health Organisation classifies edentulism as a disability. This webinar, in collaboration with the College of Ge...

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry, this recorded webinar will explore the requirements and expectatio...

More Info Purchase CPD

of verifiable CPD

Obtaining valid consent is fundamental to patient care, serving both ethical and legal responsibilities. The General Denta...

More Info Purchase CPD

of verifiable CPD

This recorded webinar highlights the vital role of Dental Hygienists and Dental Therapists (DHTs) in providing care for pa...

More Info Purchase CPD%20in%20Dental%20Practices/iStock-1352768950.jpg)

of verifiable CPD

This course aims to help learners understand the principles of equality, diversity, and inclusion within the workplace, pr...

More Info Purchase CPD

of verifiable CPD

This recorded webinar, in collaboration with the College of General Dentistry, discusses the legal, ethical, and clinical ...

More Info Purchase CPD

of verifiable CPD

This recorded webinar, presented by Nabeel Ilyas, will provide an essential guide to anaesthesia and sedation in paediatri...

More Info Purchase CPD

of verifiable CPD

In collaboration with the College of General Dentistry.As dental implants become increasingly mainstream in gener...

More Info Purchase CPD

of verifiable CPD

This recorded webinar, in collaboration with the College of General Dentistry, explores the essential role of dental hygie...

More Info Purchase CPD/iStock-1499096361.jpg)

of verifiable CPD

This course looks at the important requirements of GDPR and what should be in place to meet these regulations....

More Info Purchase CPD

of verifiable CPD

It is difficult to over stress the importance of a good history for every patient. In some cases, the history may provide ...

More Info Purchase CPD

of verifiable CPD

Most pregnant patients are generally healthy and need not be denied dental treatment solely because they are pregnant. How...

More Info Purchase CPD

of verifiable CPD

Taking care of someone with a developmental disability requires patience and skill. As a caregiver, you know this as well ...

More Info Purchase CPD

of verifiable CPD

The knowledge and skill of the dental team in managing patients with mental health problems has been cited as low. Low tol...

More Info Purchase CPD

of verifiable CPD

Should we be offering advanced sedation techniques for adults in the primary care setting or should cases that require a d...

More Info Purchase CPD

of verifiable CPD

Coronal restorations and posts can positively influence the long-term prognosis of teeth following root canal therapy. Fin...

More Info Purchase CPD

of verifiable CPD

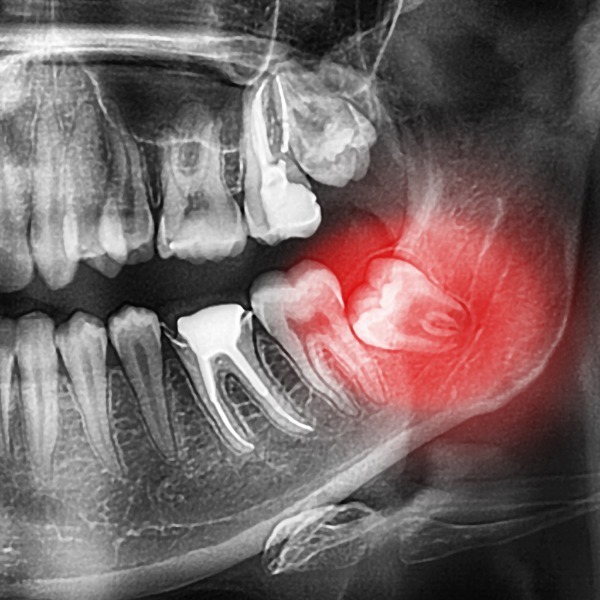

This article will address the problems and errors that may occur in the panoramic radiograph when mistakes are made at any...

More Info Purchase CPD

of verifiable CPD

This course has been produced in collaboration with Tida.It aims to provide you with clear understanding of the h...

More Info Purchase CPD

of verifiable CPD

This course has been produced in collaboration with tida. It aims to provide you with an understanding of conscious a...

More Info Purchase CPD

of verifiable CPD

This course has been produced in collaboration with tida. It aims to give you a clear understanding of what equa...

More Info Purchase CPD

of verifiable CPD

In addition to several other chronic diseases, tobacco use is a primary cause of many oral diseases and adverse oral condi...

More Info Purchase CPD

of verifiable CPD

Gingivitis, which is prevalent in a large proportion of the child and adult populations, is an inflammatory lesion of the ...

More Info Purchase CPD

of verifiable CPD

This article attempts to throw light on the nature of plaque biofilms and the strategies towards their control. Biofilms a...

More Info Purchase CPD

of verifiable CPD

Epilepsy is the most common chronic neurologic disorder in paediatric neurology and the predominant aetiologies are birth ...

More Info Purchase CPD

of verifiable CPD

Gingivitis can have multiple origins and can be the manifestation of a wide range of systemic diseases. Gingival tissue in...

More Info Purchase CPD

of verifiable CPD

Change is part of life, and we are always in a state of change, both externally and internally; physically and mentally.&n...

More Info Purchase CPD

of verifiable CPD

Like history taking, examination necessitates a systematic approach. As a general rule, use your eyes first, then yo...

More Info Purchase CPD

of verifiable CPD

On 20 October 2019 John lost his son Cameron to suicide. In this recorded webinar John talks about his journey so far and ...

More Info Purchase CPD

of verifiable CPD

With mouth cancer patients a great deal of emphasis is placed on the early detection, subsequent treatment and then hopefu...

More Info Purchase CPD

of verifiable CPD

The BDJ in Practice, November 2015 reported:'Over one-third of UK employees say that have not received appropriat...

More Info Purchase CPD

of verifiable CPD

Traditionally, oral health has been viewed as the sole responsibility of the dental fraternity. However, with increasing a...

More Info Purchase CPD

of verifiable CPD

Merskey (1979) defined pain as an, 'unpleasant sensory and emotional experience associated with actual or potential damage...

More Info Purchase CPD

of verifiable CPD

Confidentiality is essential in establishing effective clinical relationships with patients. Without an assurance of confi...

More Info Purchase CPD/P730%20Consent%20to%20care%20and%20treatment%20CQC%20outcome%202%20(Regulation%2011.jpg)

of verifiable CPD

Obtaining valid consent from patients prior to any medical or dental intervention is an ethical and legal requirement of a...

More Info Purchase CPD/P731%20Dental%20records%20CQC%20outcome%2021%20(Regulation%2020).jpg)

of verifiable CPD

A good medical or dental record should be comprehensive and accessible. It should comprise history, examination, investiga...

More Info Purchase CPD

of verifiable CPD

This learning module will help to explain the most appropriate methods of care and maintenance of handpieces in a clear an...

More Info Purchase CPD

of verifiable CPD

Under the First Aid Regulations, all workplaces must have adequate first aid provision available for all employees, althou...

More Info Purchase CPD

of verifiable CPD

Incorrect control of hazardous substances could cause harm to employees, contractors and other people.Some substa...

More Info Purchase CPD%202013/P781.jpg)

of verifiable CPD

This course gives guidance on how the Reporting of Injuries, Diseases and Dangerous Occurrences Regulations 2013 (RIDDOR) ...

More Info Purchase CPD

of verifiable CPD

Under the First Aid Regulations, all workplaces must have adequate first aid provision available for all employees, althou...

More Info Purchase CPD

of verifiable CPD

Under the First Aid Regulations, all workplaces must have adequate first aid provision available for all employees, althou...

More Info Purchase CPD

of verifiable CPD

Under the First Aid Regulations, all workplaces must have adequate first aid provision available for all employees, althou...

More Info Purchase CPD

of verifiable CPD

Under the First Aid Regulations, all workplaces must have adequate first aid provision available for all employees, althou...

More Info Purchase CPD

of verifiable CPD

It is important that staff and patients feel safe in the practice environment, early detection and management of sit...

More Info Purchase CPD

of verifiable CPD

Confidentiality is essential in establishing effective clinical relationships with patients. Without an assurance of confi...

More Info Purchase CPD

of verifiable CPD

In this module we will look at dementia - its causes, symptoms and the impact that it has. We will also look at how to rec...

More Info Purchase CPD

of verifiable CPD

This course helps you to understand and comply with the Health and Safety (Display Screen Equipment) Regulations 1992....

More Info Purchase CPD

of verifiable CPD

This course educates you about the most common slip, trip, and fall hazards and why they might develop in your workplace, ...

More Info Purchase CPD

of verifiable CPD

Change is part of life, and we are always in a state of change, both externally and internally; physically and mentally.&n...

More Info Purchase CPD

of verifiable CPD

Each year in the Health and Social Care sector around 2% of workers sustain a work related injury.78,000 self rep...

More Info Purchase CPD

of verifiable CPD

A series of 3 interactive modules looking at the cause and treatment of bleeding disorders in the dental patient....

More Info Purchase CPD

of verifiable CPD

This lecture presented by Dr Richard Cure and recorded at the Dental Nurse Educators Event, Birmingham 2018, discusses int...

More Info Purchase CPD

of verifiable CPD

This lecture presented by Dr Michael Snowden and recorded at the Dental Nurse Educators Event in Birmingham looks at mento...

More Info Purchase CPD.jpg)

of verifiable CPD

The second instalment in the 2017 Geistlich UK Webinar Series presented by Dr. Shakeel Shahdad gives a comprehensive revie...

More Info Purchase CPD

of verifiable CPD

The final instalment in the 2017 Geistlich UK Webinar Series presented by Dr. David Furze looks at Guided Bone Regeneratio...

More Info Purchase CPD

of verifiable CPD

This webinar recording, will provide a great starting point for any clinician looking to find out more about ridge alterat...

More Info Purchase CPD

of verifiable CPD

Stephen Barter has worked at Perlan Specialist Centre, Eastbourne, UK for the past ten years as part of a multidisciplinar...

More Info Purchase CPD

of verifiable CPD

Marcus Seiler received his dental training at Karl-Eberhard University in Tübingen. His specialty training in Oral Su...

More Info Purchase CPD

of verifiable CPD

A disability may be genetic, congenital (born with), or can occur at any point during a person’s lifetime, which can...

More Info Purchase CPD

of verifiable CPD

Trafficking in human beings is a modern form of slavery and is a well-known phenomenon throughout the European Union and b...

More Info Purchase CPD

of verifiable CPD

Providing oral care to people with special needs requires adaptation of the skills you use every day. In fact, most people...

More Info Purchase CPD

of verifiable CPD

Female Genital Mutilation (FGM) is child abuse and illegal.Regulated health and social care professionals are req...

More Info Purchase CPD

of verifiable CPD

This course aims to promote good clinical practice for the provision of conscious sedation in dentistry that is both safe ...

More Info Purchase CPD

of verifiable CPD

Adam Weston (partner in the law firm BLM) gives an excellent presentation on the role of the GDC, looking at what hapens i...

More Info Purchase CPD

of verifiable CPD

This video based course gives an excellent overview of why, when and how a complaint happens, the consequences of inaction...

More Info Purchase CPD

of verifiable CPD

A brief overview of the current dental negligence process in the UK, from the clinicians viewpoint. Looking at likely scen...

More Info Purchase CPD

of verifiable CPD

During this presentation, Andrew will be discussing the importance of soft tissue management when providing successful lon...

More Info Purchase CPD

of verifiable CPD

Speakers: Dr Kiaran Weil - Chair of Clinical Advisory Group, Bridge2Aid and Dr Kathy Wilson

More Info Purchase CPD

of verifiable CPD

In this talk Dr Vicky and Dr Nigel Milne explore the challenges faced by a small charity in providing dental care in a rur...

More Info Purchase CPD

of verifiable CPD

Maasai Molar was established in 2018 to provide oral healthcare in the Aitong region of Kenya. Through local partnerships ...

More Info Purchase CPD

of verifiable CPD

This recorded webinar explores NOMA as a Case Study.Speaker Dr Ife Adetula looks at how the unmet oral health nee...

More Info Purchase CPD

of verifiable CPD

Speaker - Erick Venant, Founder and CEO –RBA Initiative, Tanzania.In this recorded webinar Eric Venant expl...

More Info Purchase CPD

of verifiable CPD

Speaker Dr Rawlance Ndejjo shares experiences that they have had delivering a community cardiovascular disease (CVD) preve...

More Info Purchase CPD

of verifiable CPD

In this recorded webinar speakers Nura Aydid Ibrahim and Dr Manal Gas share their experiences bringing a me...

More Info Purchase CPD

of verifiable CPD

Speaker Dr Penelope Granger shares her experiences working as a dentist remotely, including working in Tristan Da Cunha, a...

More Info Purchase CPD

of verifiable CPD

This recorded webinar discusses the challenges and benefits of upskilling and teaching dental professionals using mobile d...

More Info Purchase CPD

of verifiable CPD

This course is a panel discussion exploring the practice of infant oral mutilation. What is it? Where does it take p...

More Info Purchase CPD

of verifiable CPD

Speaker Katie Read-Challen, BSc in Global Health (currently studying dentistry).Katie is a final year dental...

More Info Purchase CPD

of verifiable CPD

This recorded webinar is a panel discussion exploring Remote and Rural Heathcare and the Lessons Learned.The talk...

More Info Purchase CPD

of verifiable CPD

Speakers: Sarah Shoffstall-Cone - Interim Director Oral Health Promotion at Alaska Native Tribal Health, ...

More Info Purchase CPD

of verifiable CPD

In this talk Dr Nila Jackson shares with us his personal testimony, his personal experiences and solutions to the issues o...

More Info Purchase CPD

of verifiable CPD

This talk took place during Bridge2Aid's Virtual Global Health Conference November 2020 - Global Remote and Rural Healthca...

More Info Purchase CPD

of verifiable CPD

of verifiable CPD

A panel discussion to explore ethical global healthcare partnerships, the challenges involved, mutual benefits, achievemen...

More Info Purchase CPD

of verifiable CPD

Dr Merlin Wilcox gives us a fascinating insight into research into the use of 'green pharmacies' to grow effective herbal ...

More Info Purchase CPD

of verifiable CPD

In this talk, Chris explores the delivery of accessible and sustainable healthcare through the development of partnerships...

More Info Purchase CPD